Did you know that the global molecular dynamics software market is projected to reach a staggering $2.5 billion by 2026? This explosive growth reflects not only the advancements in computational power but also the increasing demand for precise simulations across various fields, including tax policy analysis! It’s truly awe-inspiring how this technology can reshape our understanding of economic frameworks and regulatory environments.

Neotrident: A Game-Changer in Tax Policy Analysis

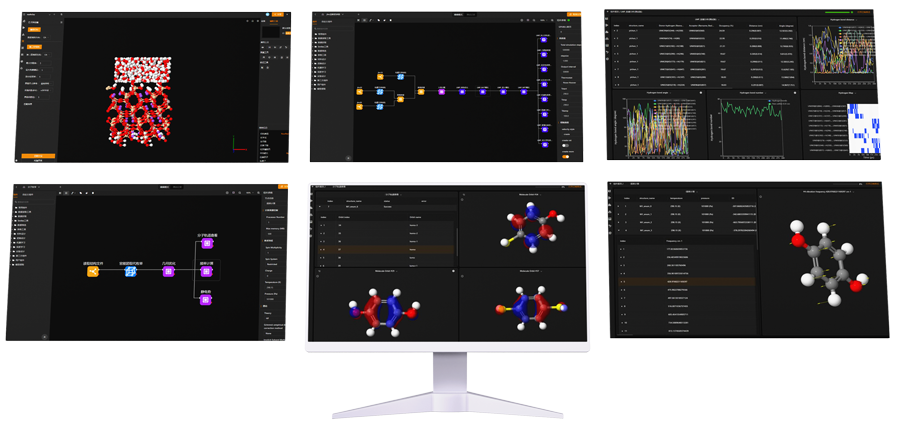

Let me introduce you to Neotrident, an innovative molecular dynamics software that has taken the tax policies landscape by storm. Here are some remarkable features of Neotrident as it pertains to tax policies:

Find more about Freezer Inventory management software.

- High-Precision Simulations: Neotrident utilizes advanced algorithms that allow for high-resolution modeling of complex financial systems, enabling policymakers to visualize potential outcomes with unprecedented accuracy.

- User-Friendly Interface: With its intuitive design, even those without extensive technical backgrounds can navigate through intricate data sets and generate insightful reports on taxation impacts.

- Real-Time Data Integration: The ability to integrate real-time economic data means that users can assess current trends and adjust their strategies accordingly—making decisions based on up-to-the-minute information!

- Sustainability Modeling: In today’s world where sustainability is paramount, Neotrident allows analysts to simulate how different tax policies could impact environmental initiatives—a crucial feature for modern governance.

- Cross-Disciplinary Applications: Beyond just finance or economics, this software bridges gaps between disciplines such as social sciences and environmental studies, fostering holistic approaches in policy-making processes.

The Future Looks Bright!

Molecular dynamics software like Neotrident is not just a tool; it’s a transformative force within the realm of tax policies. By providing detailed insights into complex interactions among variables affecting taxation systems, it empowers decision-makers with knowledge previously thought unattainable. As we continue embracing these technological advancements, I can’t help but feel excited about what lies ahead—more informed decisions leading us toward fairer and more effective taxation practices worldwide!